Ukraine-Russia Conflict

“War? That means the housing market will crash soon!” Skeptics are quick to pounce on any signs of disruption in the geopolitical sphere, capitalising on it to instil fear surrounding the drop of property prices.

The Ukraine-Russia conflict begun when Russia launched a full-scale invasion on 24th February 2022, which has led to thousands of deaths with millions of Ukrainians displaced. As the conflict is still ongoing, tension and instability have spread like wildfire.

There is no doubt that uncertainty is brewing globally, with no crystal ball to predict how this tension will unfold. We have seen the sharp increase of oil prices translating to higher energy costs which brings about inflationary pressure. Trade sanctions are imposed, which spills over to a delay in the shipment of raw materials and/or commodities. Eventually, the Ukraine-Russia conflict will unravel a series of adversities in different industries that will have significant long-term and indirect impact on Singapore.

Impact on Singapore’s Property Market

So the key question remains, how will the conflict impact Singapore’s property market?

To peer into the future, one should let the past guide their vision. Hence, to answer the question, it is recommended to understand how major world events in the past have affected Singapore’s property market.

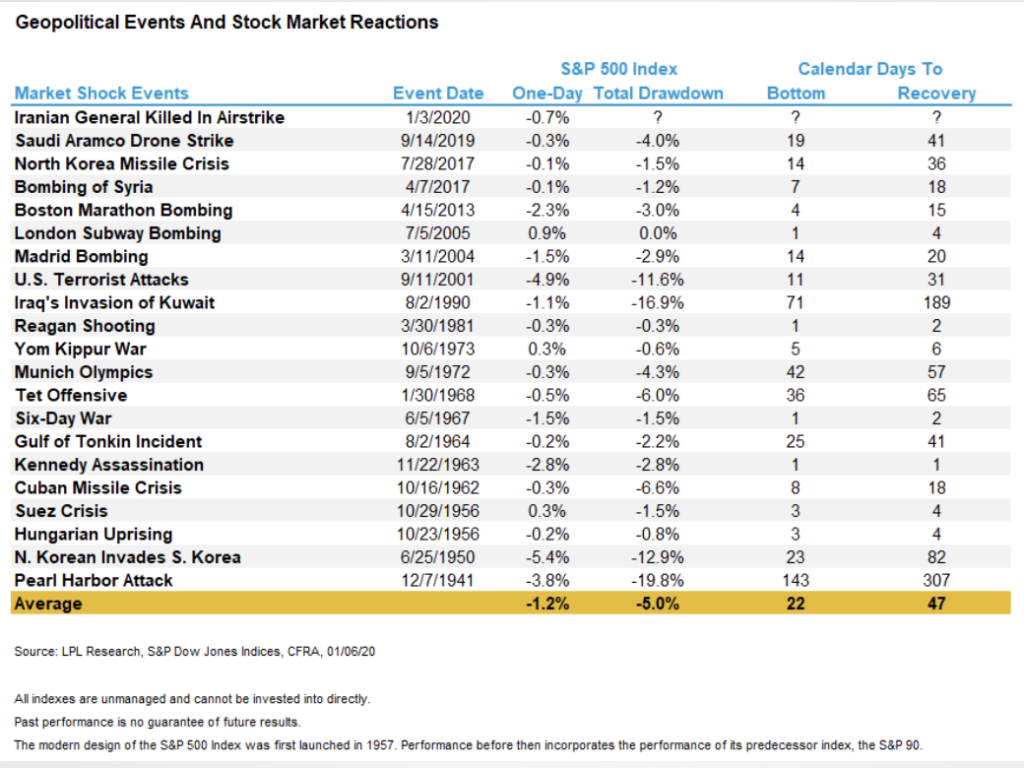

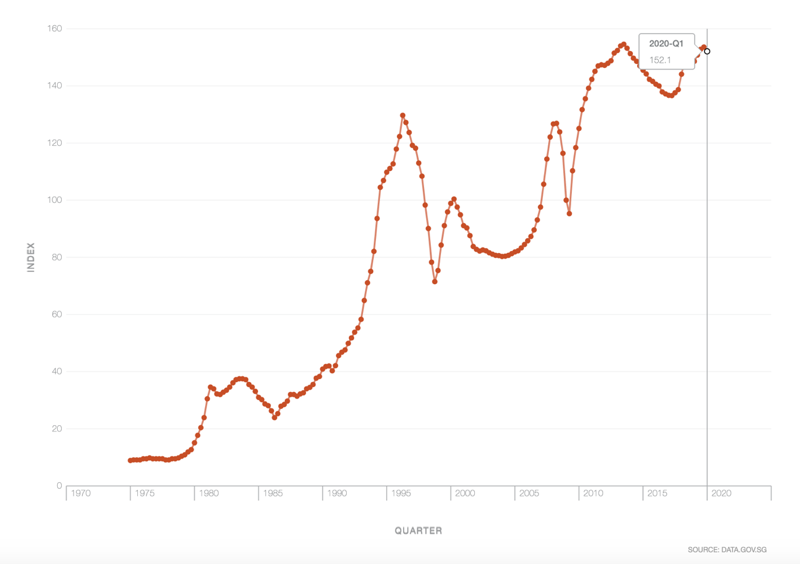

Firstly, analysis by LPL Research has evinced that the impact of war and military conflict towards the local private property is minimal. Figure 1 elucidates how the market reacts to major shock events based on the S&P 500 index. This will fuel the property market in Singapore since risk adversity has historically proven to be transient during volatile periods. In fact, past dips in the real estate market were shown to be due to non-military conflicts such as a global financial crisis or government intervention through cooling measures, as supported by the price index from data.gov.sg (figure 2).

Next, the war will likely accelerate the increase of commodities and energy prices. This inflationary pressure will affect the global supply chain, which translates to higher construction costs and ultimately leading to an increase in property prices. However, it is worth noting that commodities and energy prices have already been on an uptrend prior to the conflict. Trade and Industry minister Gan Kim Yong has already alerted that the war has clouded Singapore’s economic outlook, escalating costs with a knock-on effect on product prices. As such, developers will factor in ‘future prices’ due to the increase of material and land bank costs. Government land sales will follow suit which will result in a higher tender for developers. Moving forward, new property launches in the pipeline will continue to rise for homeowners and investors.

Unless the concern of just fear itself can totally bring the demand to a halt, which is unlikely since housing is an essential need, the sensible way then is to look at the impact from the inter-connected consequences coming forth from the supply chain. This ultimately leads to the end product price, i.e. property price, where the daunting truth falls onto home buyers… property prices will be increasing at a faster rate.

Hopeful Future

Investors know too well that investing in real estate is a hedge against inflation. This is especially true for property value. CBRE recently announced that in 2021 and 2022, Singapore has been consecutively ranked within the top 3 destinations investors find attractive. The Monetary Authority of Singapore (MAS) also expects the Singapore economy to remain on track to grow at a creditable pace of 3-5% for 2022. Hence, since the conflict in Ukraine and Russia only accelerated costs of property prices that was already in motion, investing in real estate is still opportune.

As an evergreen asset class in a prosperous land with scare resources, Singapore remains a stable and safe nation for living and investing. With increase in global political instability, a large influx of foreign investments will be flowing into our nation. All in all, it seems that Singapore’s property market remains bullish in 2022.